Without much fanfare, and under the shadow of Brexit and Theresa May's vote of confidence, Derek Mackay MSP, Finance Secretary of Scotland, delivered the latest draft budget for Scotland on the afternoon of Wednesday 12 December 2018.

For us, the main focus was always going to be on the taxes levied by Holyrood.

Where we stood

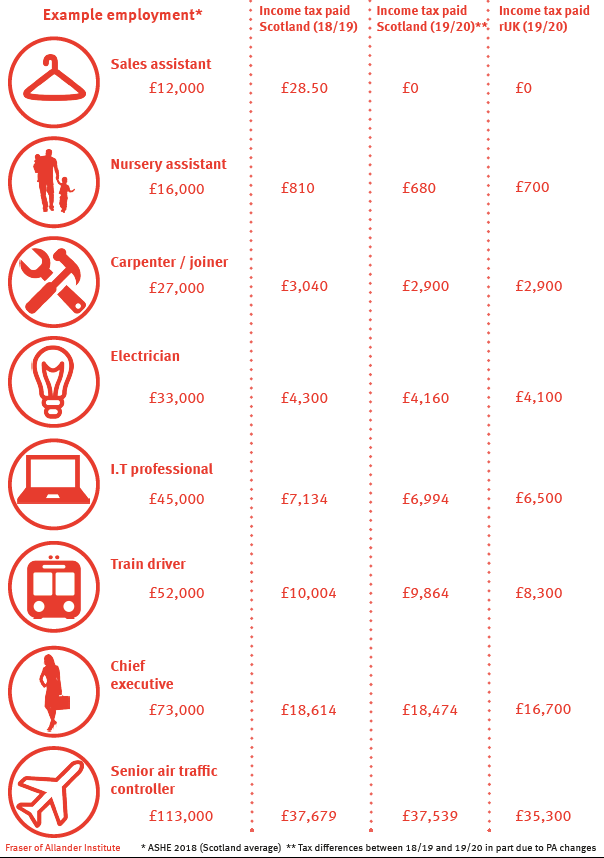

Last year, Mr Mackay took advantage of Scotland's powers to vary income tax; he introduced a convoluted system of new tax bands, which some believed earned him the right to headlines which boast that he was a Robin Hood-esque saviour of the lowest earners. He increased the tax on the highest earners, and increased the disparity between earners floating around the £40k-£50k mark in comparison to their counterparts in the rest of the UK.

Since then, the UK Government announced further increases to the basic rate band (from 6 April 2019), meaning that from that date if you earn £50k per annum or less, you will only pay basic rate income tax (20%).

Going into this Scottish budget, the pressure was on for SNP to close the gap between Scotland and England.

So where are we now?

Well, we're no further on from where we were.

Scottish workers paying a whopping 53% of taxes and NI. In England this is only 32%.

Mr Mackay announced yesterday that he would effectively be freezing the Scottish income tax rates & higher rate bands. No matching of the UK Government. A real-terms decrease to the money in the pockets of workers and entrepreneurs in Scotland.

This means that someone earning roughly £16k in Scotland, will pay £20 less in tax than someone in their position living in England. This was always SNP's headline-grabber - the real-terms difference this £20 makes to the relatively small number of people who benefit from it is up for debate. However, for someone earning £50k, they pay £1,544 more than their colleagues down in England.

Because the power to set National Insurance isn't devolved to Scotland, the above Scottish worker's employment income earned between £43,430 and £50,000 results in paying a whopping 53% of taxes and NI to the treasury's coffers. In England this is only 32%.

Let's head for the border!

Steady on.

Scotland is a great country (I'm slightly biased). Living and working in a great country has a lot to be said for it, and after all, happiness & life satisfaction is worth more a few extra £££. Unlike some critics, I don't believe that the current tax differences alone are likely to create a mass migration to south of the border.

However, if more than half of our time could disappear in taxes, perhaps it's time to take stock of what matters to us most.

half of your time will be spent working for the taxman . . . sure, you keep the other half, but does it equate to an hourly rate which you're happy to achieve for your efforts?

On the face of it, the above tax disparities in combination with a failure by the SNP to introduce any revolutionary incentives to small businesses (as this would cost them money) does little to encourage Scottish entrepreneurship. However, it perhaps offers a great opportunity for a bit of reflection on what our time's actually worth.

For example, you've been successfully running a small business and are making a nice profit of £35k-£40k per year. You're weighing up whether to push on and grow the business further. Once you tip into that £43k+ bracket, you know that half of your time will be spent working for the taxman.

Sure, you keep the other half, but does it equate to an hourly rate which you're happy to achieve for your efforts?

Dropping down to a 4 day week, and enjoying time with your family in the beautiful country we live in might instead be the perfect way forward!

The hourly rate of happiness is priceless.

Other news - the landlord attack continues

The Additional Dwelling Supplement (ADS) which is payable on the purchase of a second home is set to increase from 3% to 4% with effect from April 2019.

This means that for a purchase of a letting property costing £180,000 you will now have to find £7,200 additional cash up-front to cover the ADS, in addition to any Land and Buildings Transaction Tax (LBTT) which would otherwise be payable.

This non-mortgageable cost continues to be significant for prospective residential landlords, and further increases the requirement to 'do your numbers' to ensure that your letting venture will provide you with a worthwhile return for your investment.

Watch this space!

However, all of the above might be irrelevant in the event of a no-deal Brexit, with Mr Mackay himself saying that he might 'tear up his plans' and announce a new budget in light of the circumstances at that time.

And even before then, the SNP must still gain the support of at least one other party in Holyrood in order to pass this draft budget. There is the possibility that some of the other changes thrown around the chamber yesterday may still be taken into consideration before the final bill is passed.

Either way, we'll continue to peel through the legislation and will keep an eye on any developments!